Should you buy an EV? Seems like a trend...

Let's get the most obvious reason out of the way first. EVs are easier, smoother, quieter and more fun to drive than ICE cars. By a lot. Also, instant heat in the winter, and full blast AC when stopped in the summer.

But, you don't generally buy a car for that. You buy it for transportation and you want it to be economical. Here, it's a bit muddier - but maybe not as much as you might think.

Best case. You own two cars, one is ICE. You have access to 240 VAC in your garage/driveway. Most of you driving is local. You enjoy driving. An EV is a slam dunk. It will save you a lot of money and you'll fight over who gets to drive it.

Worst case. You only have one car. You have no daily access to 240 VAC charging. Most of your driving is road trips. You live in a cold climate. Here, you really need both eyes open before you decide on an EV. It'll be require more daily planning and may not save you much at all.

First some basics.

A battery is not a gas tank.

"Filling" a battery requires some knowledge. Similar to having to know what grade of fuel and oil you need to feed your ICE car, you need to know some things about your battery and chargers.

Cost of electricity

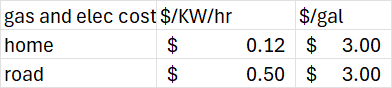

While the cost of gas varies only a little from place to place - currently about $3-4/gallon for regular, the cost of electricity for your EV can vary a lot.

Residential rates: Typically about 12 cents a KWhr, but can vary from 4 cents to 25 cents depending on location and rate plan. This is generally 3 to 4 times cheaper than gasoline for local driving.

Fast DC chargers: These generally vary from 30 cents to 60 cents a KWhr. This is the same, or more than gasoline for ICE cars for highway driving.

Free charging: Yes, free! There are lots of businesses that offer free charging. If you are eating out or going to a movie or shopping, you often can grab 5-10 KWhrs of juice while you're out. Some employers offer free charging for employees, as well.

Charger types

There are three types of chargers. Level 1, level 2 and Fast DC.

1. Level 1 is what you can get from a regular electrical outlet. A level one charger will get you a bit more than1 KW, or 5 miles for every hour you charge.

2. Level 2 is 240 VAC and typically 30 amps or more. This can get you up to 11 KW, or 50 miles for every hour you charge, although many are about half of this. If you have an electric dryer not too far from where you park your car, you have access to level 2 charging.

3. Fast DC charging is depends on two things. The rating of the charger and the car's on board charger. The best will be over 200 KW, the worst, 30 KW.

Take-away: The sweet spot is having a level 2 charger in your garage.

The battery

There are two main types of battery chemistry in use, and although the "best practices" vary between them, generally, these things are true.

1. You generally don't want to "fill" to 100%. unless you're heading out on a trip. If you fill to 100% all the time, your battery life will degrade a bit faster. (this 100% rule doesn't apply to LFP batteries, which are becoming more common)

2. You generally want to charge a little bit, often, rather than a lot, infrequently. It's better for the battery to go from 60-80% every day than 20-80% every three days. (In fact, if you do this all the time, your battery will last 800,000 miles before it degrades 15%)

3. Fast DC charging rate will vary depending on battery state. If the battery is over 80%, the rate will decrease as the battery approaches "full". If the battery is cold, it will charge much more slowly than if it is warm. Many cars have battery heaters that allow you to warm the battery before charging.

4. For fast DC charging, the rate the battery will charge depends on the car, not the charger.

5. Fast DC charging is generally a bit harder on the battery than charging on a level 1 or 2 charger.

Take-away: Having a level 2 charger at home means you can start out every day "full" (or nearly so)

Road trips vs local driving.

Cost of charging vs gas.

Charging at home is typically 8-12 cents per KWhr. Charging at a fast DC charger is between 30 and 60 cents a KWhr, depending on time of day and vendor. Gasoline is running about $3/gallon.

At 2.8 KWhr per mile (typical highway efficiency) for an EV and 25 mpg for an ICE car, and 50 cents per KWhr and $3/gallon, that's 17 cents per mile for EV and 12 cents per mile for ICE.

But, remember, that the "first tank" for the EV is likely at the much cheaper residential rates, so, a 400 mile trip with 150 miles at the residential rate of 12 cents and the rest at 50 cents per KWhr averages out to 13 cents per mile - about the same as ICE.

Battery size and range

Most cars have batteries between 50 and 100 KWhr and have range between 200 and 350 miles.

Most people rarely drive more than 100 miles a day.

Range only becomes an issue on road trips. This isn't a show stopper - but it does require more attention than taking an ICE car on a road trip. More later.

Take-away. Most EVs are perfect for most people, most days.

Charge planning

Assuming you have access to level 2 charger, start your day with 80% charge, 100% if going on a road trip, or need the range for the day. Plug car back in and charge back up to 80% at the end of the day while you sleep. Simple. Cheap. Much better than having to plan a stop at a gas station every few days.

If you are driving more than your range, plan on a stop to charge. This is typically going to be a fast DC charger. This is NOT just like stopping for gas. It requires some planning. It takes longer. Chargers are not ubiquitous.

Here's the basics.

1. It takes as much time on the charger to go from 20 to 80% as it does to go twice from 50 to 80%, so plan all your meal and rest stops around charging and charge every time you stop.

2. There are no signs along the highway, so use a route planning tool or Google Maps, or car's navigation system to find and plan your stops. Make a quick list and do some Google maps street view scouting before you go to know what your alternatives are and what the amenities near the charger are like.

3. Know what the charger rating is and know how fast your car can charge. A 350 KW charger will NOT charge your car that fast if your onboard charger can only do 125 KW.

Trying to go from 20-80% at a 60KW charger on your 100 KW hr battery will take an hour. Maybe okay for a meals stop. Going from 50-80% on a 150 KW charger will only take 12 minutes. Just about enough time to hit the restroom or grab a coffee.

4. Use a planning tool to adjust your plan on the fly. Need a rest stop sooner, or want to push a bit more down the road or want to avoid waiting for a charger? You need to do some planning.

5. Do you have use of Tesla Superchargers? If you do, you have a lot more choices and far fewer time spent waiting in line for a charger. Know that some cars, for technical reasons, will charge about half as fast on a Tesla charger than other fast DC chargers. (Teslas have 400 VDC batteries. Some others have 800-900 VDC batteries and will not charge as fast on Tesla chargers).

6. The planning tools will often show you the price. It can vary a lot. I know that the Florida Power and Light chargers are only about 30 cents a KWhr, while Electrify America is 56 cents, for example. Choose wisely. Save money.

7. The planning tools will often have ratings and reviews and will indicate if some of the chargers are broken. They also cann tell you how many are in use, currently. Good for avoiding lines.

8. Download the app and set up an account for each of the charger brands you plan to use. Some require the app to use, or at least, use reliably.

9. If driving in cool/cold weather, make sure you understand what triggers your battery conditioning. For Tesla and Hyundai (and others?), you generally have to have your onboard navigation system routing to that charger.

10. Charging port. Does your car have a NACS (Tesla) charging port or a CCS1/J1772 (most everything else) port? You might want to purchase and adapter plug, depending on your circumstances, to expand your options. Note, just having a CCS1 to NACS adapter doesn't mean you can charge your car at a Tesla Supercharger. The Supercharger has to support your brand and car model, specifically.

11. If your trip includes an overnight stop, try to find a hotel with free level 2 charging. Use your planning tools to find out which hotel have one and how availability works and what the cost is. Also, check a few reviews to make sure others have had good luck there.

Also know

Reliability. EVs currently on the market have terrible to average reliability. They also have much simpler design and far fewer moving parts. Then, why is this? They should be more reliable, right? EV design is still evolving and some parts and systems are still being refined as automotive engineers tweak the design. Use Consumer Reports to separate the "naughty" from the "nice" and to find out what the trouble spots are. I am expecting EVs to have "bullet-proof" reliability as some point in the future, but they are not there, yet.

Maintenance. Wiper blades and washer fluid, cabin air filter and rotate the tires. Occasionally the battery coolant. That's it. Brakes will last almost forever since most braking is regen. No oil changes. No transmission fluid. No timing belts. No antifreeze. No carbon build up, intake or throttle body cleaning.

Towing. You can tow with many EVs, but know that it will absolutely clobber your range - like in half. Some newer EV pickup trucks have really huge batteries to get better range, but that extends your charging time at fast DC chargers. The market isn't really there yet, for the full time RVer - unless you have a motor home and have a TOAD. An EV would be an ideal TOAD.

Cost to replace the battery

This is the biggest "red herring" out there! Yes. Some people have had their batteries replaced because they fail prematurely. But, the battery warranties are really long and failure rates are really miniscule. Batteries will degrade a bit over time, but real world experience has shown degradation is slower than predicted by lab tests. Even if you don't generally follow the "best practices" for your battery, you'll have 85% or better at 200,000 miles.

Some use cases

1. You are a family of four, have two cars. Both used for daily commutes during the day, and kid taxi on evenings and weekends. Once a month, there are long vacation road trips of 300 - 1000 miles, one way. One of your cars should be an EV. Period. End of sentence. Use the ICE for road trips.

2. You are single and live in an apartment complex. You commute every day and take 400 mile road trips two weekends a month. Can you charge at work? Does your complex have a level 2 charger? Can you move to a place that does? Can you lobby your landlord to install some? Can you sneak an extension cord out a window to your car for level 1 charging? If not, an EV is likely going to be more work than you're willing to take on. Think hard about it before you take the plunge.

3. You are married and live in urban home with street parking. Commuting is by transit. Vacation travel is by air. Why have a car at all? Rent one when you need one. Maybe the EV for you is and Ebike.

Conclusion

Should you buy an EV? Right now? Mostly yes, but know what you're getting into. As EV technology and design improve and charging becomes more ubiquitous, the yes/no line will move and EVs will be even cheaper, more reliable and easier to own.

It's really a matter of "when", not "if.